myob is currently introducing and rolling out their new secure invoicing platform

MYOB recognises that the cybersecurity landscape is constantly evolving, with new threats emerging daily - and have recently advised that as part of their continuous development and investment in solutions to address these challenges, they are introducing a new secure invoicing platform in their SME subscriptions.

This new platform requires that business owners be verified. The verification process uses the AUSTRAC KYC (Know Your Customer) and Beneficial Owners guidelines to determine these procedures. The AUSTRAC beneficial owners guidelines state that no matter how far down the structure an individual's ownership extends, if they hold more than 25% control, they are included in this verification process. MYOB's verification process is in partnership with FrankieOne.

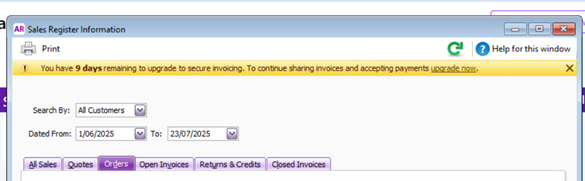

As they roll this out to their customers, we expect that you will see a pop up in the software that looks like the image below.

We have been in touch with MYOB about this process and they understand that some clients may need additional time to arrange documents when prompted. They have advised that, through our manager, we can work with MYOB to arrange extension for clients who need additional time to get the required material together. This will ensure email invoicing can continue during that extension timeframe. They will require the Business Name and the MYOB serial number - so if you need an extension, please provide your serial number when you contact us.

If you have a MYOB file and only occasionally issue invoices, you can bypass the verification process. Then though, you would still raise the invoice in MYOB, but would need to download the invoice and send it by email as a PDF - that is, not send it directly out of the software.

MYOB have provided these links for any additional information you may require.

https://www.myob.com/au/support/security/secure-invoicing-upgrade

https://info.myob.com/au/lp/pr/secure-invoicing

https://www.myob.com/au/support/Turning Online Payments On or Off